Fiserv

Commerce Hub Platform

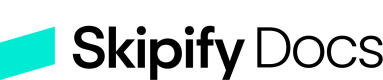

Getting a Fiserv merchant account

If you don’t already have a Fiserv merchant account, you can sign up for a test account here.

The test account will allow you to get started with Skipify in sandbox mode but you’ll need to work with Fiserv to get a production merchant account. Please ask your Skipify contact if you need any help with this!

The next step is to select which Fiserv merchant account you’d like to use for Skipify transactions.

Retrieving your payment gateway credentials:

Like Skipify, Fiserv has a two-tier (parent-child) account structure. Transactions are processed at a merchant account level, and payouts are made to the bank account associated with that merchant account.

You can set up one Fiserv merchant account per Skipify child account, or use the same Fiserv merchant account for multiple Skipify child accounts. If you’re unsure, please work with your implementation manager to determine what’s best for your business set-up.

Skipify uses your API credentials to process transactions with Fiserv on your behalf. To do this, we use the following credentials:

- API Key

- Secret

- MerchantID

- TerminalID

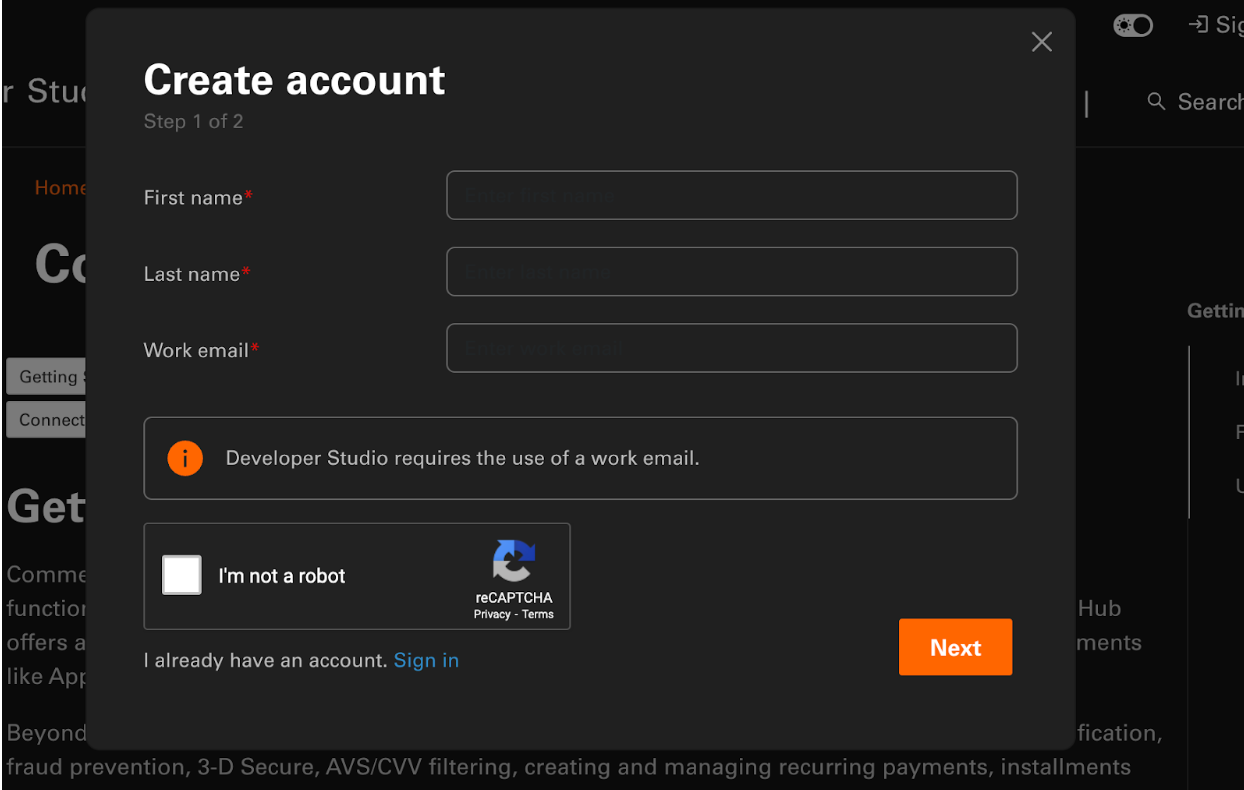

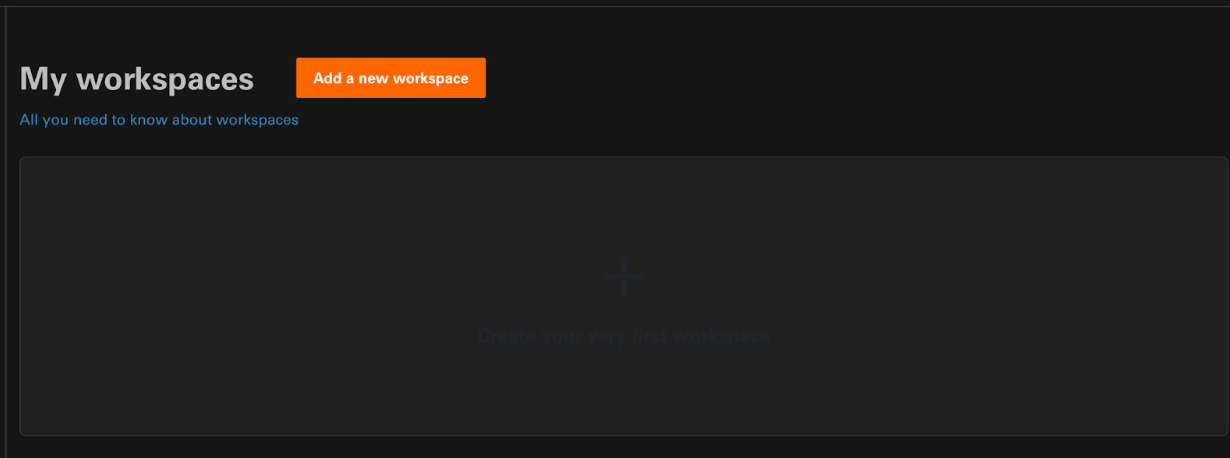

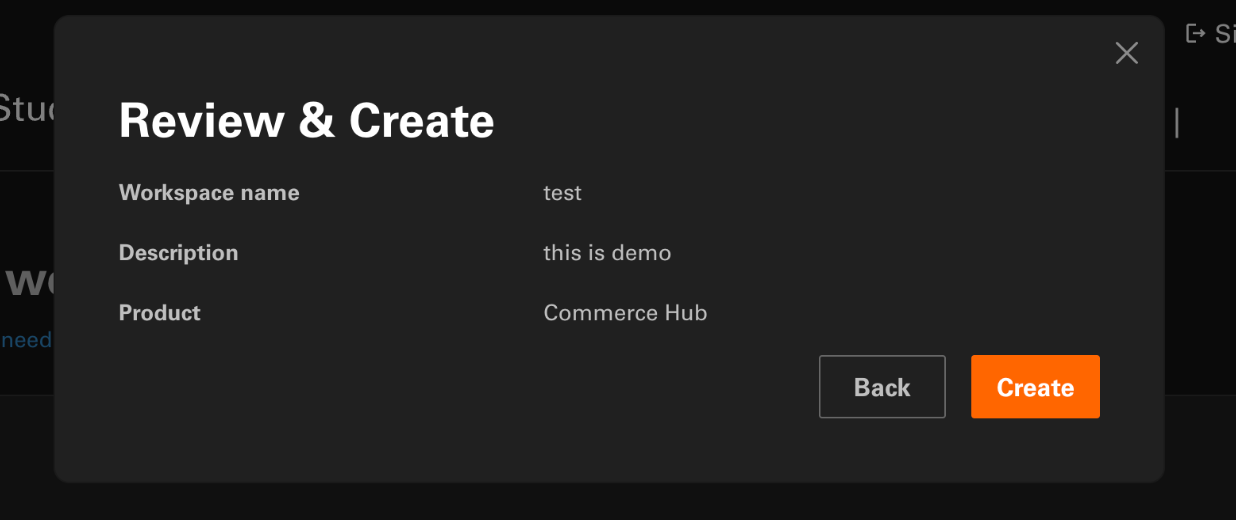

If you already have a Fiserv account and have access to these credentials, provide it to your Skipify implementation manager. Otherwise, you can generate a new API key by following the instructions below from the My workspaces area to Add a new workspace

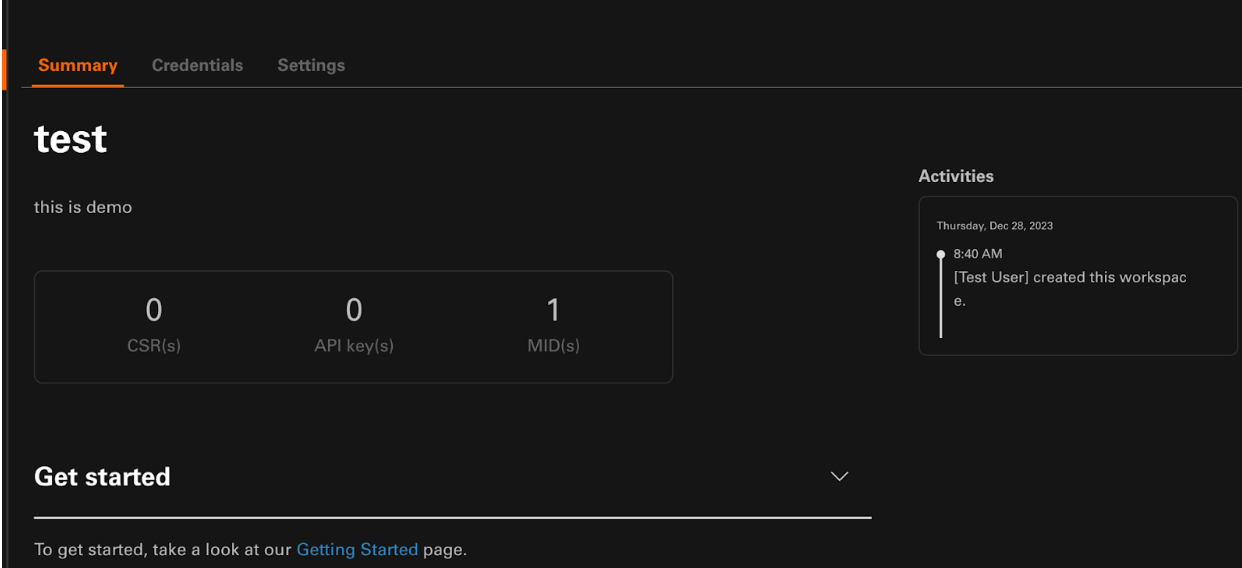

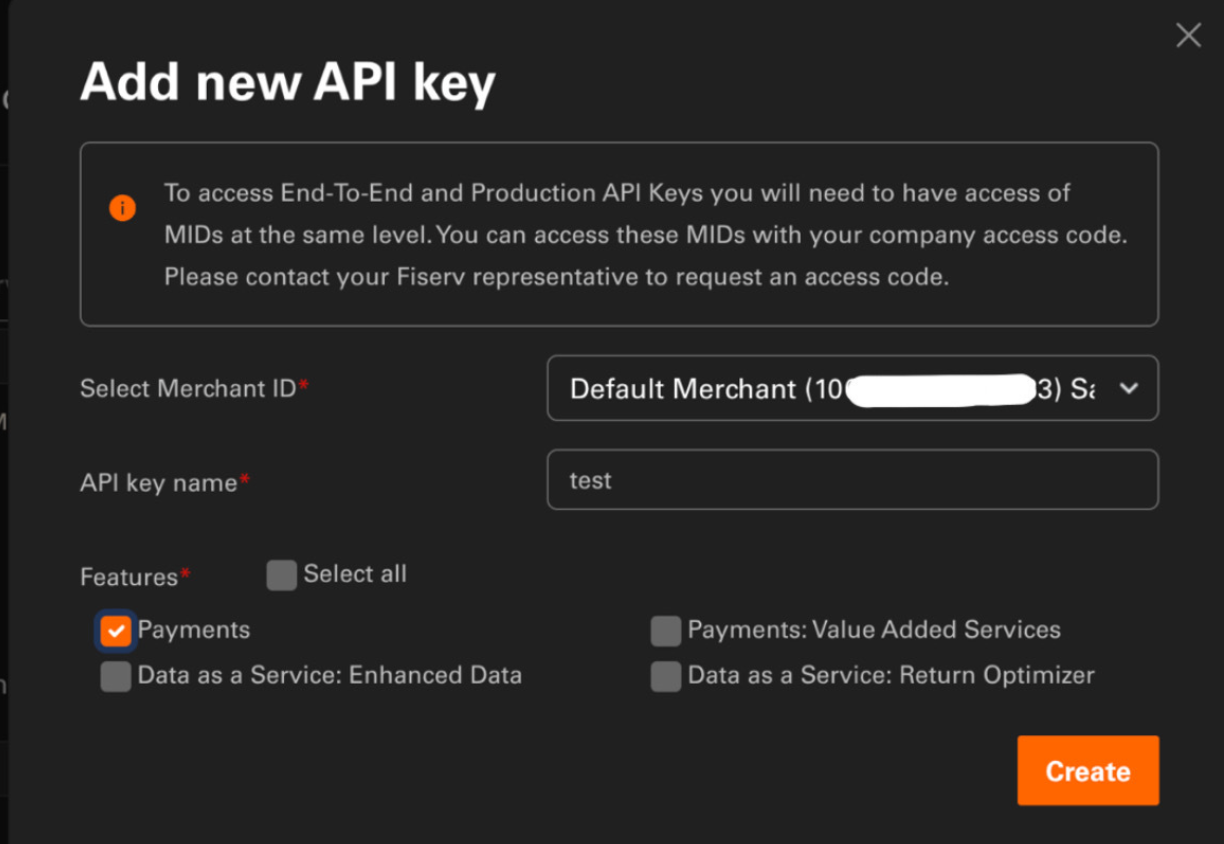

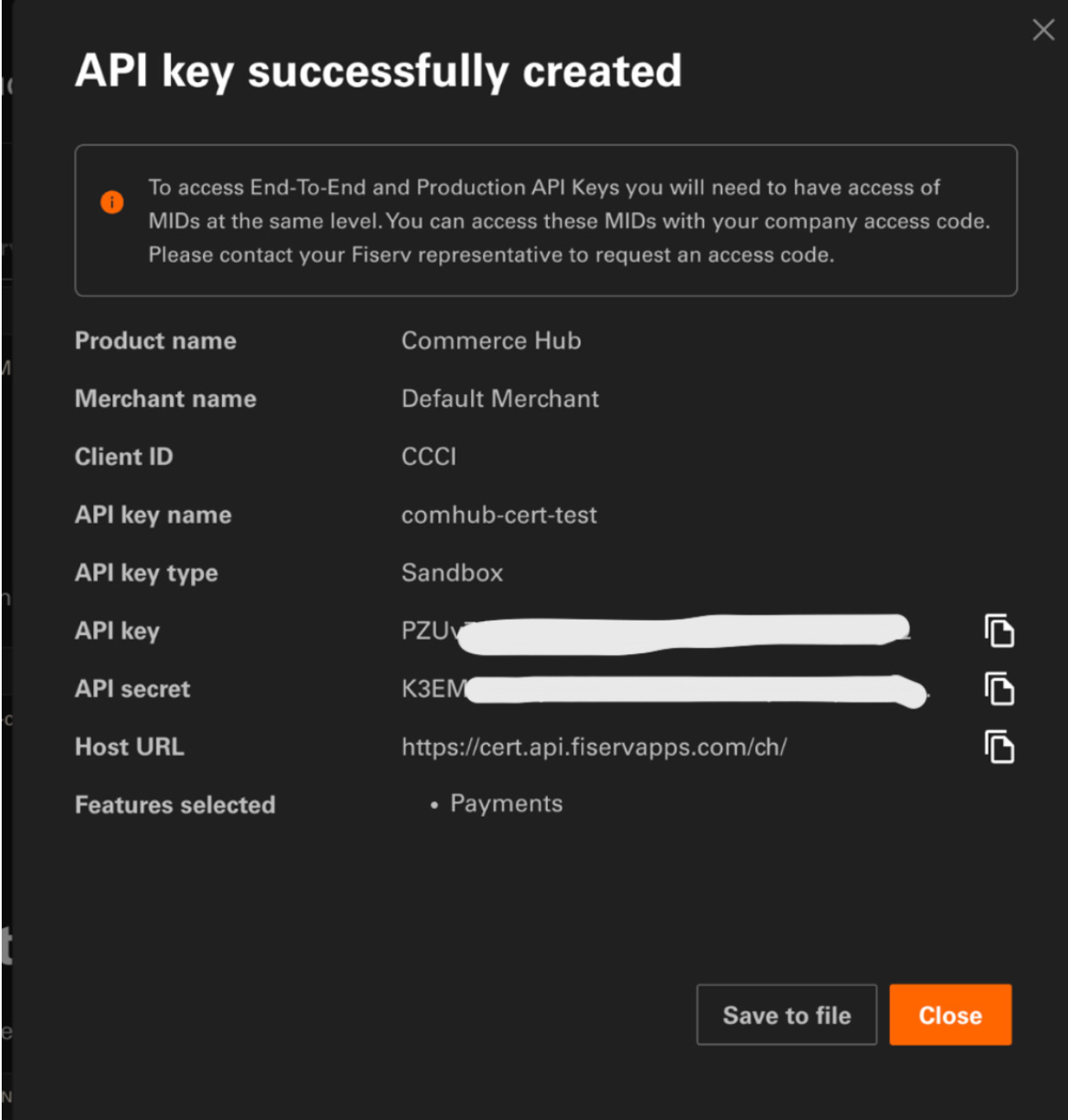

Once these steps are completed, you will see the below screen. Navigate to the Credentials tab to access your MerchantId and TerminalID . The next step is to create the Api Key.

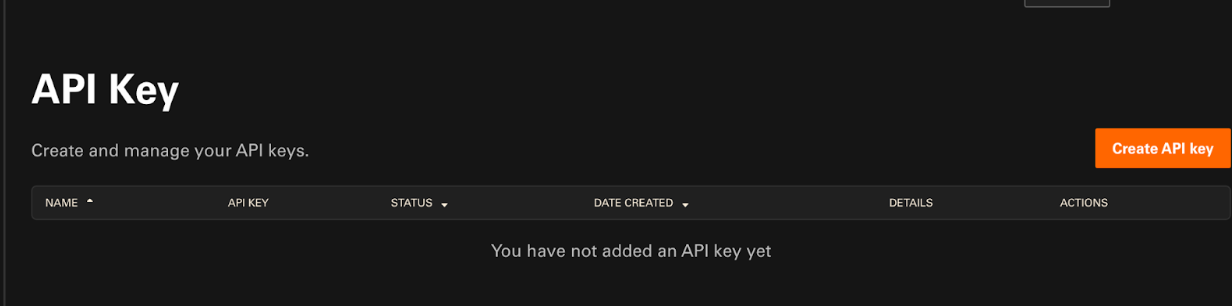

Select Create API key.

Once completed, you can access the API Key and API secret.

Skipify Merchant Portal

Next, you'll need access to the Skipify Merchant Portal. If you need an account, your favorite Skipify integration manager can get you setup quickly, or you can submit a request here!

Set Fiserv as your Payment Gateway

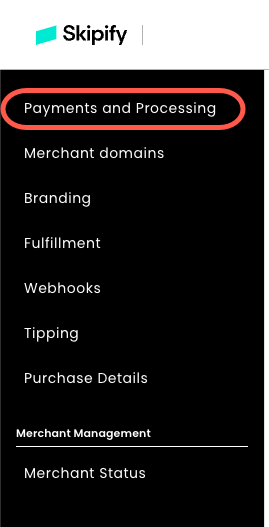

Log into the Skipify Merchant Portal and click on the payments and processing tab.

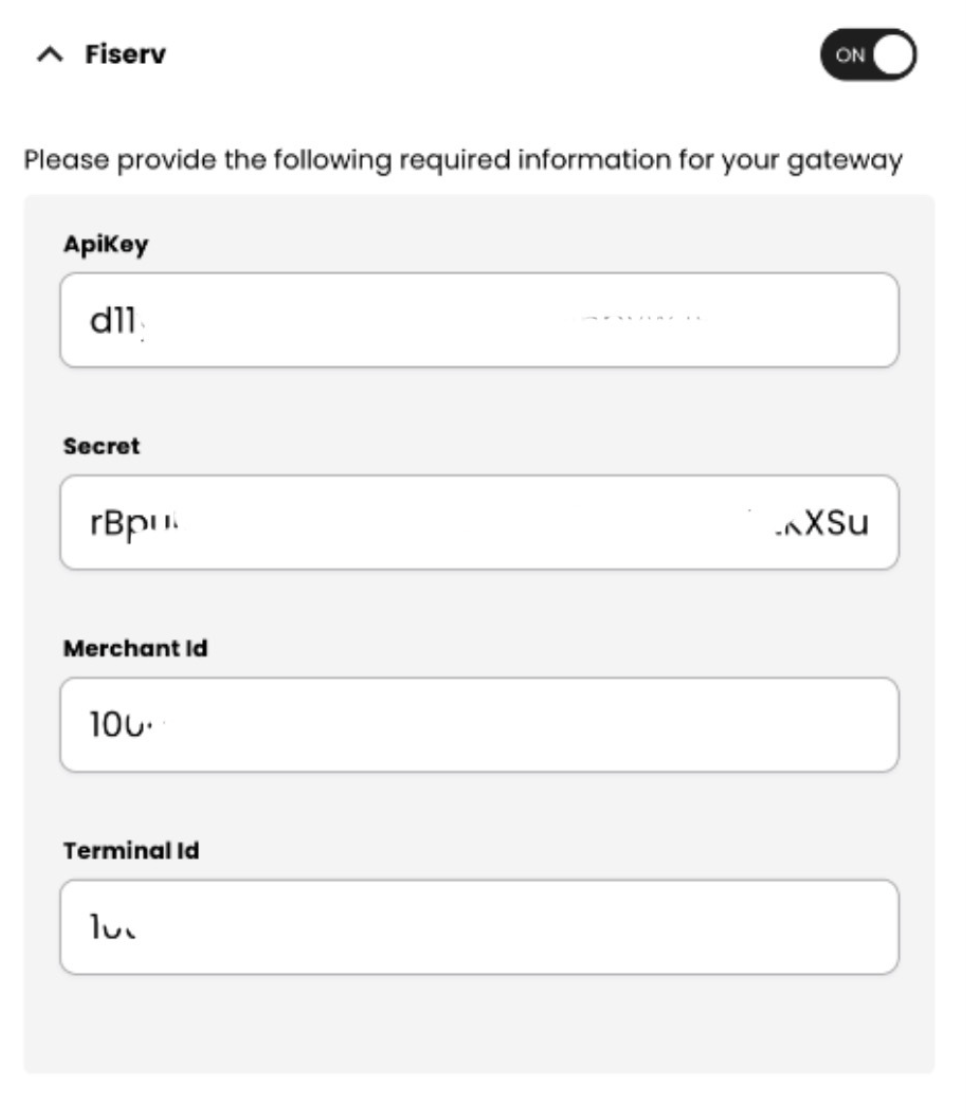

Select Fiserv as your payment gateway and fill in your Fiserv merchant id, terminal ID, API key, and secret in the fields provided. Skipify will verify these credentials so if you get an error, please check that you’ve entered the correct credentials for the correct environment. You’ll need Fiserv test credentials for Skipify sandbox and Fiserv production credentials for Skipify production.

Getting an error message?Please check that the credentials entered are for the correct environment. If you're still having issues, your favorite Skipify implementation manager is happy to help!

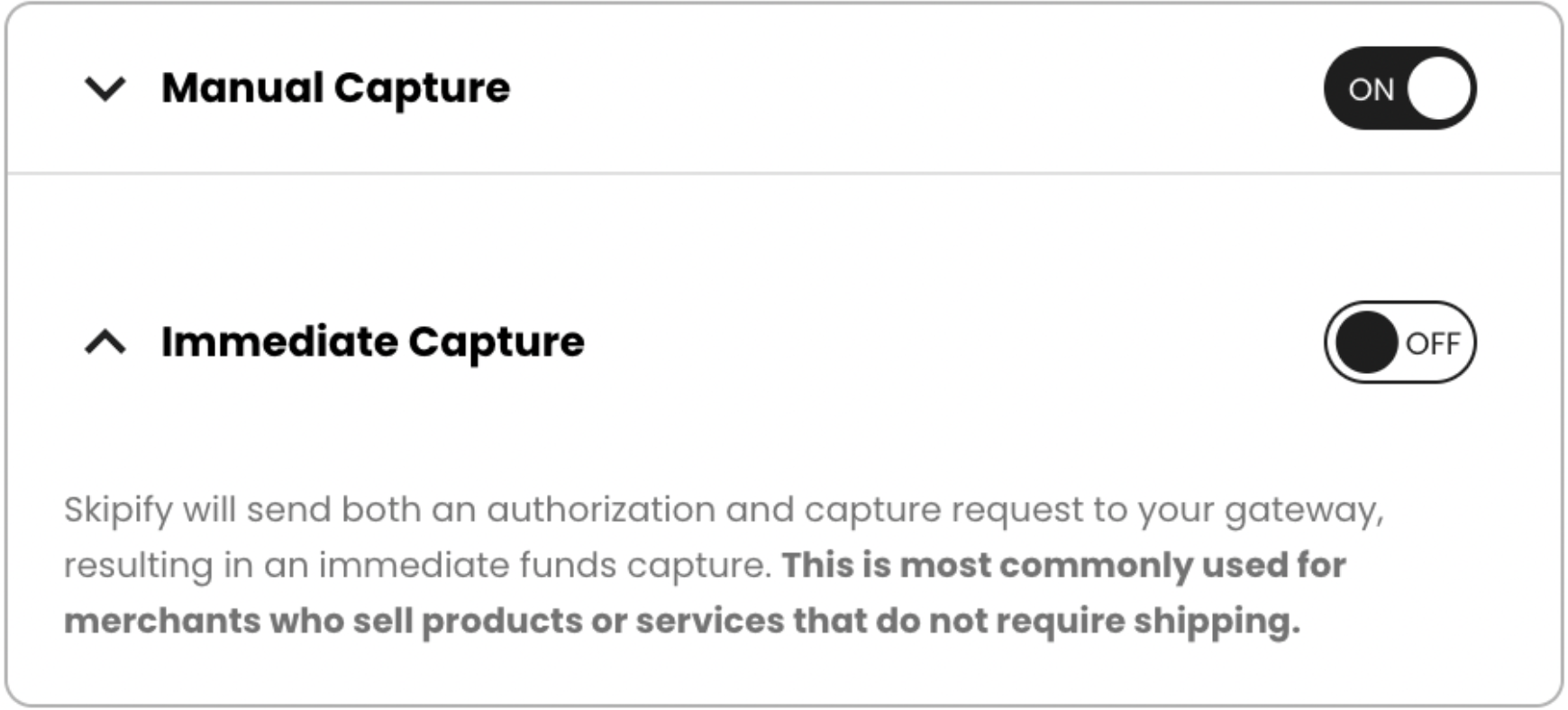

Choose your Capture Settings

Indicate if you would like immediate or manual capture. Immediate capture means transactions will be authorized and captured at the same time. Manual capture means you must trigger a capture when you’re ready to collect funds. Manual capture merchants can request a capture either directly with your payment process or via Skipify. (link to capture docs when those become available on Skipify). If you are set for manual capture and you do not trigger a capture, no funds will move, and the card networks can fine the merchant for this.

Manual Capture is usually used by merchants who ship physical goods and need to hold off on capturing funds until the items are ready to go. With this option, Skipify will only send an authorization request to your payment gateway. You will be responsible for capturing funds when you're ready, either directly with your gateway, or via Skipify's capture endpoint.

Immediate Capture is usually used by merchants who have already provided a service, or who provide access to digital goods once authorization is complete. With this option, Skipify will authorize and capture funds at the same time.

Updated 7 days ago